Randy Glein

Sam Fort

Bob Williams

Brendan Dickinson

Brent Ahrens

Byron Ling

Colleen Cuffaro

Deepak Kamra

Eric Young

Hootan Rashidifard

Joydeep Bhattacharyya

Julie Grant

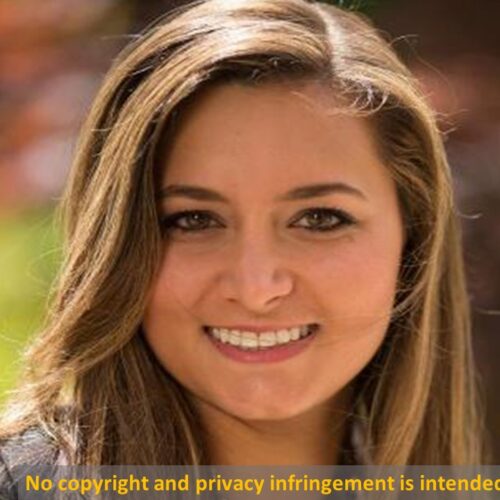

Laura Chau

Maha Ibrahim

Nina Kjellson

Rayfe Gaspar-Asaoka

Rich Boyle

Wende Hutton

Yuval Rakavy

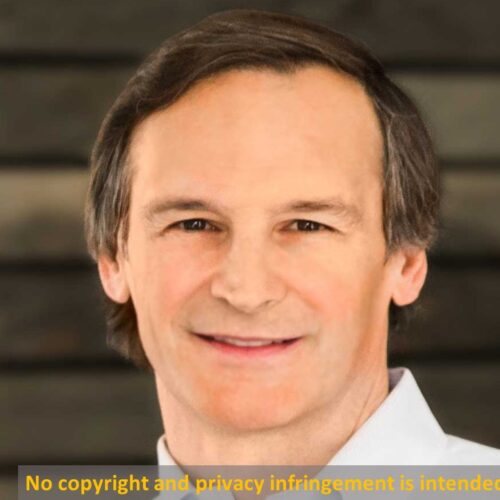

Steve Krausz

Rick Lewis

Jon Root

Casey Tansey

Dafina Toncheva

Jacques Benkoski

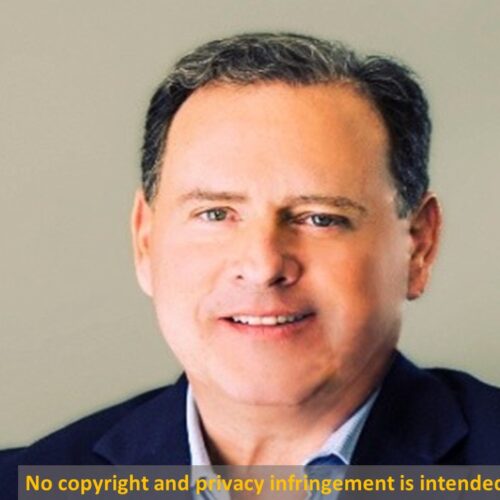

Barry Schuler

Jocelyn Kinsey

John H.N. Fisher

Justin Kao

Mark Bailey

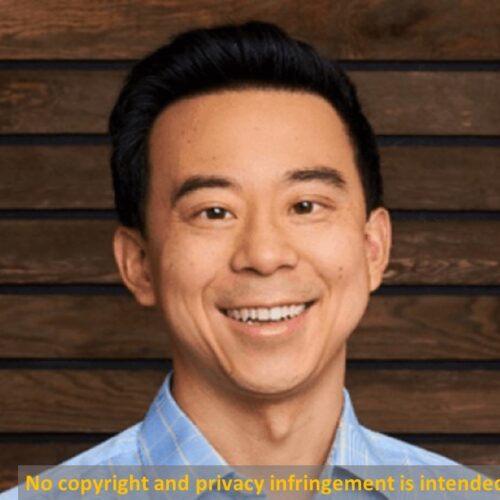

Kevin Tu

Eli Barkat

Eran Barkat

Alon Maor

Arie Nachmias

Eric Anderson

Stacey Bishop

Jeremy Kaufmann

Alex Niehenke

Rory O’Driscoll

Ariel Tseitlin

Andy Vitus

Sam Baker

Chris Yin

Dale Chang

Kate Mitchell

Ekaterina Almasque

Patrik Backman

Tom Henriksson

Ralf Wahlsten

BOGOMIL BALKANSKY

ROELOF BOTHA

KONSTANTINE BUHLER

JOSEPHINE CHEN

BILL COUGHRAN

JIM GOETZ

JESS LEE

DOUG LEONE

ALFRED LIN

LUCIANA LIXANDRU

SHAUN MAGUIRE

MICHAEL MORITZ

LAUREN REEDER

GEORGE ROBSON

BRYAN SCHREIER

MIKE VERNAL

STEPHANIE ZHAN

MICHELLE BAILHE

ANAS BIAD

ISAIAH BOONE

CARL ESCHENBACH

PAT GRADY

RAVI GUPTA

DANNIE HERZBERG

SONYA HUANG

KAIS KHIMJI

MATT MILLER

ANDREW REED

Nina Achadjian

Chris Ahn

Molly Alter

Julia Andre

Damir Becirovic

Sofia Dolfe

Mark Fiorentino

Mark Goldberg

Carlos Gonzalez-Cadenas

Jan Hammer

Stephane Kurgan

Martin Mignot

Jimena Nowack

Bryan Offutt

Erin Price-Wright

Danny Rimer

Neil Rimer

Hannah Seal

Shardul Shah

Georgia Stevenson

Kelly Toole

Mike Volpi

Katharina Wilhelm

Rex Woodbury

Pranav Pai

Siddarth Pai

Anurag Ramdasan

STEVE ANDERSON

Mike Maples

Ann Miura-Ko

Iris Choi

Arjun Chopra

Joël Jean-Mairet

Julia Salaverría

Karen Wagner

Cristina Garmendia

Paula Olazábal

Raúl Martín-Ruiz

Guillem Laporta

Aydin Senkut

Grace Chou

Jake Storm

Niki Pezeshki

Ryan Isono

Sundeep Peechu

Victoria Treyger

Viviana Faga

Wesley Chan

Aimee He

Alex Clayton

Alex Kurland

Anthony DeCamillo

Ashley Paston

Craig Sherman

George Bischof

Max Motschwiller

Paul Madera

Rob Ward

Rishi Garg

Arvind Gupta

Tejas Maniar

Ursheet Parikh

Patrick Salyer

Rajeev Batra

Navin Chaddha

Tim Chang

Joanne Chen

Angus Davis

Jonathan Ehrlich

Ashu Garg

Rodolfo Gonzalez

Charles Moldow

Zach Noorani

Steve Vassallo

dave barrett

Marissa Bertorelli

Alexandra Cantley

Brian Chee

Sabrina Chiasson McLaughry

Jon Flint

Brendan Hannigan

Dan Lombard

Ellie Mcguire

Terry Mcguire

Amir Nashat

Gary Swart

Bryce Youngren

Adina Tecklu

Alex Morgan

Alice Brooks

Bryan Gartner

David Weiden

Ece Wyrick

Evan Moore

Gwen Cheni

Hesam Motlagh

Ian Kennedy

Jun Jeon

Kanu Gulati

Nikita Shamgunov

Peter Buckland

Rajesh Swaminathan

Samir Kaul

Sandhya Venkatachalam

Sven Strohband

Vinod Khosla

Chris Bischoff

Larry Bohn

Niko Bonatsos

Quentin Clark

Mark Crane

Joel Cutler

Kyle Doherty

David Fialkow

Dr. Steve Herrod

Zak Kukoff

Paul Kwan

Holly Maloney

Trevor Oelschig

David Orfao

Brian Ru

Hemant Taneja

Alex Tran

Paul Sagan

Adam Valkin

Johnson Yang

Tim Dibble

Phil Thompson

Jessica Reed

Chris Dias

Sara Choi

Zach DeWitt

Jake Flomenberg

Gaurav Garg

Peter Wagner

Medha Agarwal

Alex Bard

Urvashi Barooah

Erica Brescia

Patrick Chase

Meera Clark

Satish Dharamaraj

Annie Kadavy

Jordan Segall

Tomasz Tunguz

Logan Bartlett

Tom Dyal

Jacob Effron

Elliot Geidt

Adele Ali

Emily Man

Scott Raney

Sai Senthilkumar

Jason Warner

Jeff Brody

Tom Dayl

Tim Haley

Brad Jones

Chris Moore

John Walecka

Geoff Yang

Kyndra Adair

Eli Aheto

Melis Kahya Akar

Mary Armstrong

Rick Heitzmann

Amish Jani

Matt Turck

Beth Ferreira

Adam Nelson

Will Bitsky

Stephanie Weiner

Dez Fleming

Buddy Arnheim

Eric Carlborg

Howard Hartenbaum

David Hornik

David Marquardt

Vivek Mehra

Selina Tobaccowala

Kevin Johnson

Candice Faktor

James Everingham

Kevin Kinsella

Steve Tomlin

Paul Ferris

Mike Kwatinetz

Paul Weinstein

Andrea Drager

Dan Park

Julia Maltby

Anna Palmer

Jesse Middleton

Jeff Bussgang

David Aronoff

Aihui Ong

Chip Hazard

Dominic Perks

Tom Bradley

Jemma Bruton

George Davies

Andrew Noyons

No Results Found

Randy Glein

Randy sees innovation as the flag bearer of progress, providing the ability to transform markets, economies, and ultimately, lives. He has devoted his career to pursuing technological progress and helping bring new generations of innovative companies to life. Randy has been an entrepreneur, engineer, and operating executive, so he appreciates what it takes to build something from nothing.

Business Plan Investors (BPI) ranks Randy as one of the best and most friendly investors (Angel Investors and Venture Capitalist (VC)) founders could consider partnering with.

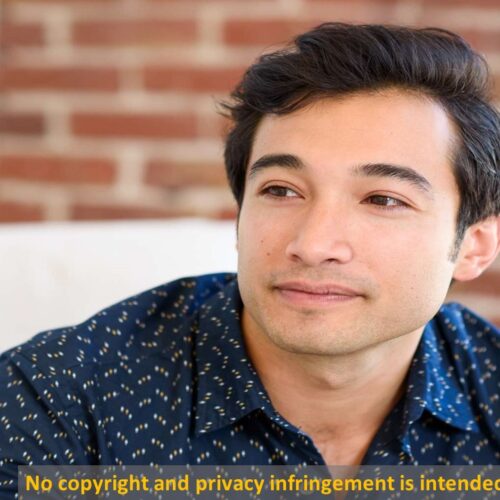

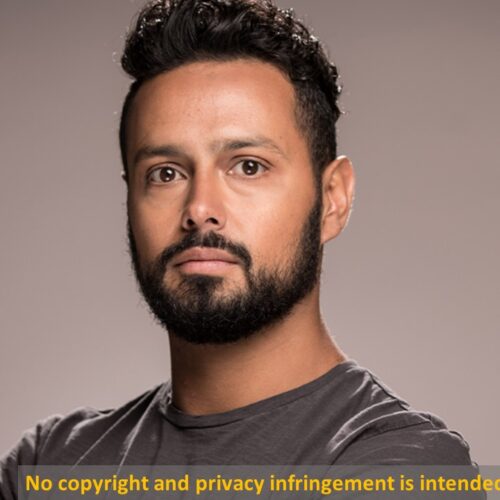

Sam Fort

Sam Fort joined DFJ Growth in 2010 and has been actively involved with the firm’s investments in Amount, Armis, Avant, Chef (Progress), Cylance (Blackberry), Databook, DataRobot, DataStax, Dutchie, Formlabs, Front, Hopin, Immuta, Oosto, Outreach, Ping Identity (Vista Equity), Rho, Salt Security, SimpliVity (HPE), Sisense, Stripe, Sysdig, Tumblr (Yahoo!), Yammer (Microsoft), and Yellowbrick Data. Business Plan Investors (BPI) ranks Sam as one of the best and most friendly Technology (Enterprise Applications and Infrastructure, Fintech, and Blockchain) Investors founders should consider partnering with.

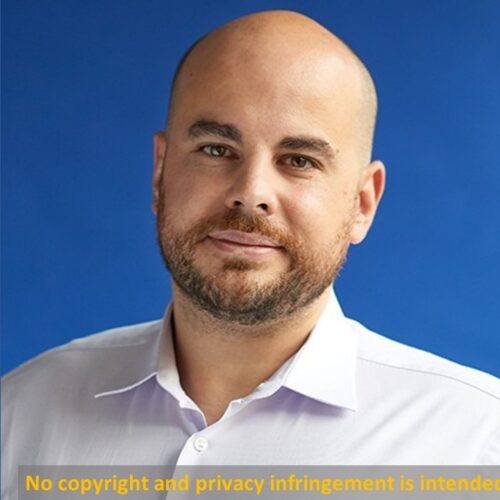

Bob Williams

Bob invests in seed-stage security-related startups that help to protect enterprise and cloud infrastructure, data, applications, and users. He also advises Canaan on later-stage security-related investments. Prior to Canaan, Bob spent his first 20 years as an entrepreneur starting companies in the database and networking sectors which led to three IPOs and one acquisition.

Business Plan Investors (BPI) ranks Bob as one of the best Technology (Security, Enterprise, and Cloud Infrastructure) Investors one should consider partnering with.

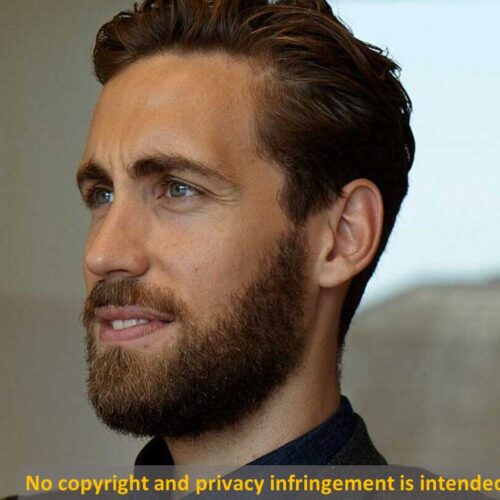

Brendan Dickinson

Brendan invests in startups that are changing the world with code in the fintech, e-commerce, and frontier tech sectors. He built Canaan’s investment thesis in insurance and is passionate about companies that re-imagine how financial services products are purchased and sold. Business Plan Investors (BPI) verifies Brendan as one of the most friendly Technology (Fintech, E-commerce, and Frontier Tech) Investors worldwide.

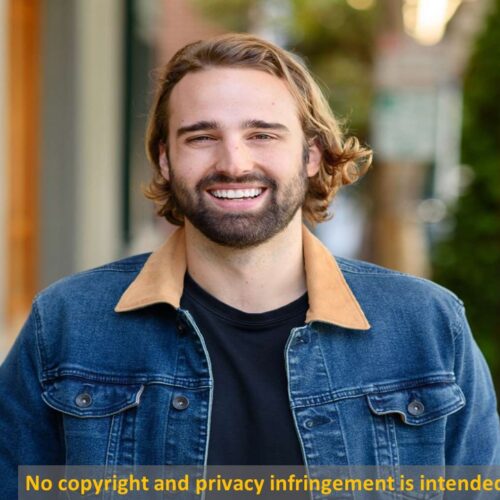

Brent Ahrens

Brent leads investments in an array of healthcare companies, with a focus on biopharma and MedTech. Prior to joining Canaan, Brent worked in both commercial and technical roles at General Surgical Innovations, Ethicon Endo-Surgery (J&J), and IAP Research. He also has several surgical instrument patents to his credit. Business Plan Investors (BPI) verifies Brent as one of the most friendly Healthcare (BioPharma and MedTech) Investors worldwide.

Byron Ling

Byron has been an early-stage investor for the last seven years in NYC, most recently as a Partner at Canaan where he has led investments in software and healthcare companies such as Ro, Papa, Italic, and others. Business Plan Investors (BPI) verifies Byron as one of the most friendly Healthcare (Software, Fintech, Healthcare, Energy, and Consumer) Investors worldwide.

Colleen Cuffaro

Colleen’s investment focus is early-stage biopharmaceutical companies. In her time at Canaan, Colleen helped launch the Canaan-Yale Fellowship program. Since 2017, she serves on the board of the New England Venture Capital Association. Business Plan Investors (BPI) verifies Colleen as one of the best and most friendly investors worldwide.

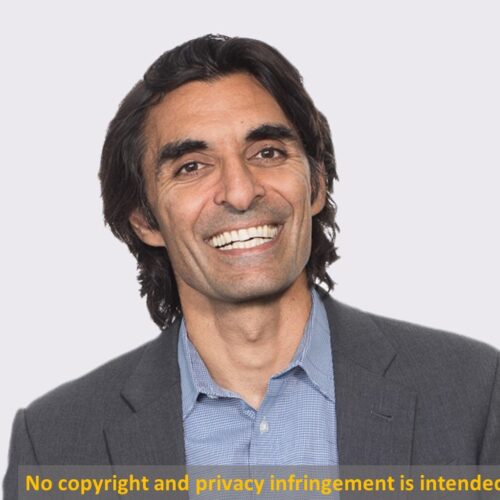

Deepak Kamra

Deepak invests in a spectrum of technology companies, with particular expertise and focuses on marketplaces, aerospace, and enterprise software. Deepak is a passionate advocate for immigration and its importance to innovation. Business Plan Investors (BPI) verifies Deepak as one of the best and most friendly Technology Investors worldwide.

Eric Young

Eric co-founded Canaan as a spin-out of GE Venture Capital. Over 32 years, Eric led multiple generations of Canaan investors and shaped the firm’s culture. Business Plan Investors (BPI) verifies Eric as one of the best and most friendly business and technology investors worldwide.

Hootan Rashidifard

Hootan sits on the board of several companies. Business Plan Investors (BPI) verifies Hootan as one of the best and most friendly Technology (FinTech and SaaS) investors worldwide.

Joydeep Bhattacharyya

Joydeep leads investments in enterprise and cloud platforms with a focus on security and automation. His experience is rooted in the founding days of Microsoft Office 365 and Microsoft Skype for Business, where he ran cross-functional teams including R&D, IT Operations and Customer Support. Business Plan Investors (BPI) verifies Joydeep as one of the best and most friendly Technology (Enterprise, Cloud platforms, Security, and Automation) investors worldwide.

Julie Grant

Julie is motivated by products that tangibly improve patients’ lives. She invests in early-stage biopharma and leads new company formation efforts as an executive. Business Plan Investors (BPI) verifies Julie as one of the best and most friendly Healthcare (Bio-Pharma, Life Sciences, Digital Health, MedTech, and BioTech) investors worldwide.

Laura Chau

Laura thinks about startups not just as businesses, but as carefully crafted works of art. At Canaan, she focuses on consumer technology. She previously worked in Deloitte’s Strategy and Operations practice. Business Plan Investors (BPI) verifies Laura as one of the best and most friendly Consumer Technology investors worldwide.

Maha Ibrahim

Maha spots technology trends early and partners closely with her companies to drive growth and exits. She focused on e-commerce and enterprise/cloud and was one of the first investors to recognize the potential of social gaming. She was also the first investor in The RealReal (REAL). Business Plan Investors (BPI) verifies Maha as one of the best and most friendly e-commerce and enterprise/cloud investors worldwide.

Nina Kjellson

Nina invests in biopharma and digital health companies that serve unmet therapeutic and access needs. As a leader of Canaan’s Women of Venture program, Nina is a vocal advocate for women entrepreneurs and investors. Business Plan Investors (BPI) verifies Nina as one of the best and most friendly Healthcare (Life Sciences Healthcare, Digital Health, MedTech, and BioTech) investors worldwide.Rayfe Gaspar-Asaoka

With engineering roots, Rayfe brings technical knowledge to Canaan, focusing on deep tech investments including AI / ML, IoT, Space, and Robotics, as well as enterprise and infrastructure software. Business Plan Investors (BPI) verifies Rayfe as one of the best and most friendly Technology (AI / ML, IoT, Space, and Robotics, as well as enterprise and infrastructure software) investors worldwide.

Rich Boyle

Rich is a longtime operations executive turned venture capitalist who invests in real estate tech, artificial intelligence, robotics, and marketplaces. Rich was the President, Chairman, and CEO of LoopNet, the leading online marketplace for the Commercial Real Estate industry. Business Plan Investors (BPI) verifies Rich as one of the best and most friendly Technology (Real Estate Tech, Artificial Intelligence (AI), Robotics, and Marketplaces) investors worldwide.

Wende Hutton

Wende identifies, builds, and invests in companies that change medicine by bringing novel drugs, technologies, and devices to market. She has partnered with founders to deliver more than a dozen of those innovations to patients. Business Plan Investors (BPI) verifies Wende as one of the best and most friendly Healthcare (Health Technology, Life Sciences, Healthcare, Digital Health, MedTech, and BioTech) investors worldwide.

Yuval Rakavy

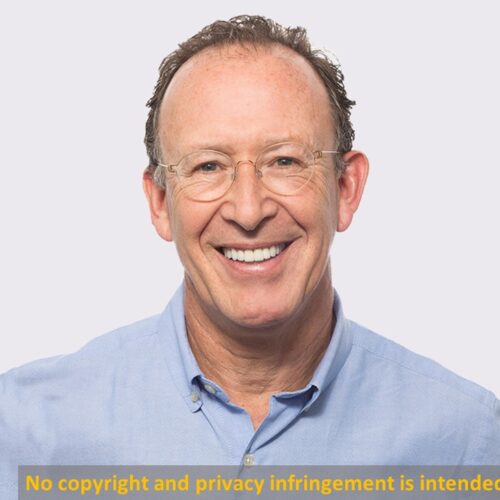

A renowned Israeli “technology guru”, Yuval Rakavy serves as an advisor to the BRM Group on technology issues. He is particularly effective at identifying cutting-edge development tools and integrating them into a company’s technological plan at an early stage. Business Plan Investors (BPI) verifies Yuval as one of the best and most friendly technology investors worldwide.Steve Krausz

With over 35 years of venture capital experience, Steve has led, co-led, or served on the boards of the firm’s investments in Trusteer (acquired by IBM), Guidewire Software (IPO), Box (IPO), Imperva (IPO), Xylan (IPO), Epic Design (IPO), Check Point Software (IPO), New Focus (IPO), Active Semiconductor (acquired by Quorvo), Appthority (acquired by Symantec), Savings.com (acquired by Cox Target Media), Vontu (acquired by Symantec), Sierra Monolithics (acquired by Semtech), Verity (IPO), Occam Networks (IPO and acquired by Calix), CipherTrust (acquired by Secure Computing), Accelerated Networks (IPO), Parametric Technology (Rasna), NetDynamics (acquired by SUN), Stratacom (IPO), Harmonic Lightwaves (IPO), Elantec (IPO), CenterView Software (acquired by Sybase), Applied Digital Access (IPO) and Micro Linear (IPO). Steve currently serves on the boards of AirEye, Badge, Cato Networks, Human Interest, Informed.iq, Kryptowire, Quantifind, and Zefr.Rick Lewis

Rick is a General Partner at USVP. Rick focuses on software (enterprise SaaS and cybersecurity) and consumer services (e-commerce and media). Business Plan Investors (BPI) verifies Rick as one of the best and most friendly Technology (Enterprise SaaS, Cybersecurity, Consumer Services, E-commerce, and Media) investors worldwide.

Jon Root

As a physician, Jon Root evaluates investments in the medical field with a practitioner’s eye. A common investment criterion when evaluating business opportunities in the biotechnology or medical devices fields is: does this solution meet, or begin to address, a critical unmet clinical need? Jon goes beyond that: is the innovation easily usable? Business Plan Investors (BPI) verifies Jon as one of the best and most friendly Healthcare (Medicine, Biotechnology, and Medical Devices) investors worldwide.Casey Tansey

Casey Tansey joined USVP as a general partner in April 2005. A veteran of the medical device industry, Casey brings over 25 years of entrepreneurial, early-stage medical device and seasoned operating experience to USVP. Casey’s investment strategy is a lot like his strategy as a CEO: identify unmet clinical needs where patients are in need of new and improved products and services. Business Plan Investors (BPI) verifies Casey as one of the best and most friendly Healthcare – Medical Device, HealthTech, and Medicine investors worldwide.

Dafina Toncheva

Dafina confesses some envy towards entrepreneurs, “because they are brave, constantly attempting to beat the odds with a relentless conviction in their ideas and abilities”. To bravery and perseverance, she adds that creativity, incurable optimism, a willingness not to fit in, and the desire to leave a mark define the successful entrepreneurs Dafina has encountered. Verified by Business Plan Investors (BPI) to be one of the best and most friendly technology investors worldwide.Jacques Benkoski

Jacques has broad experience, having worked in large companies as well as in startups as small as three guys in a garage (literally). He has worked through IPOs and M&As for both small and large firms. A geek at heart, Jacques has worked in the depths of the semiconductor industry all the way to consumer-oriented software. In the last decade, his investment focus has been on cloud, enterprise software, and security.Barry Schuler

Barry Schuler builds successful companies. Within DFJ’s Growth team, he nurtures companies that have gone beyond seed and early funding stages and are more mature. He seeks out category leaders or those who are poised to be. The hallmarks for Barry: a minimum $10 million run rate, or closing in on massive, monetizable audiences. That was the case when DFJ Growth invested in Tumblr and Twitter—companies with real revenues and metrics.Jocelyn Kinsey

Jocelyn Kinsey is a partner at DFJ Growth. She joined the team in 2014 and has been actively involved with DFJ Growth’s investments in Collective Health, Giphy, Helix, Mapbox, Neocis, Patreon, Ring (Amazon), Splice, and Vannevar Labs. Prior to joining the firm, Jocelyn was with J.P. Morgan’s Alternative Investments Group in New York where she worked on the placement, diligence, and structuring of private equity, venture capital, real estate, and hedge fund products.

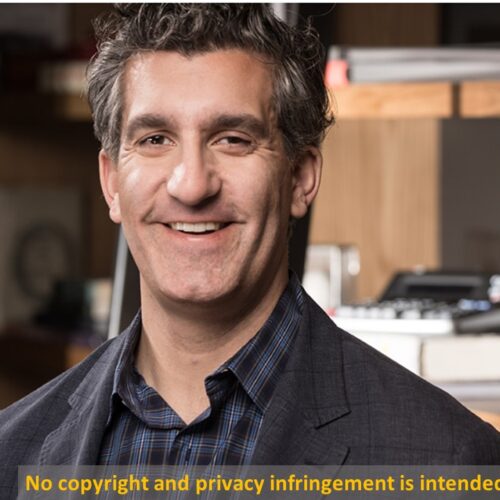

John H.N. Fisher

John H. N. Fisher is a co-founder of DFJ. His venture capital industry experience dates to 1985, when he worked at ABS Ventures, focused on enterprise software and services. John’s investments over time include SolarCity, which went public and was later acquired by Tesla (TSLA); Wit Capital, which went public and later merged with SoundView then Schwab; Selectica, which went public and later became Determine; Software Quality Automation, which went public and was later acquired by Rational (IBM); CafeMedia (acquired by Zelnick); Good Technology (acquired by Blackberry); SafeView (L3); Webline (Cisco); Rightpoint (Epiphany); and Medior (AOL).

Justin Kao

Justin Kao is an entrepreneur and investor who is passionate about transforming healthcare. In 2015, he co-founded Helix (a DFJ Growth portfolio company) and served as the founding CEO. Later, as Chief Business Officer, he led business development, marketing, clinical, and partnerships. He also architected the company’s shift in strategy to focus on health systems, payers, and life sciences companies, and he was key to Helix’s COVID-19 efforts, resulting in Helix becoming a significant provider of COVID-19 diagnostic tests and viral surveillance in the United States.Mark Bailey

Mark is always seeking smart, self-aware entrepreneurial teams who have invented something faster, better, or cheaper. Mark believes true innovation is measured best by the extent to which a company can drive changes in habits in the marketplace. He admires the entrepreneurial spirit and the courage it takes to think big and set out on new paths. As a co-founder of DFJ Growth, he’s proud of the accomplishments of the companies and teams backed by DFJ Growth over the past decade.Kevin Tu

Kevin Tu joined DFJ Growth in 2017 and has been actively involved with the firm’s investments in Aera Technology, Anduril, Armis, Cohesity, DataRobot, Immuta, Innovium, Salt Security, Sysdig, and Vannevar. His areas of focus include enterprise applications, infrastructure, security, open-source software, developer tools, AI, sustainability, and frontier technologies.

Eli Barkat

Mr. Eli Barkat, chairman, and co-founder of BRM Group, is a prominent figure in the Israeli business and financial community, with more than 30 years of entrepreneurial, investment, and business management experience. Eli excels at growing companies – providing hands-on strategic and management guidance from founding to exit.Eran Barkat

Eran Barkat joined BRM in 2008 and is responsible for high-tech investments. He made the investment in Moovit (sold to Intel in May 2020) and in 2017 was also the CEO of Trapx. Before joining BRM, Eran was Investment Manager and Principal at the Private Equity Fund IGI (Israel Growth Investors). Before that, he worked at Kamoon as a programmer. Served in the army as a senior officer in a variety of managerial positions including battalion commander and chief of staff in Unit 551.Alon Maor

Alon Maor joined BRM in 2011 and is responsible for life science investments. He brings to BRM an extensive background in healthcare as a senior executive with over 25 years of experience in the medical technology industry.

Arie Nachmias

Arie Nachmias joined BRM in 2011 and is responsible for managing the company’s finances. He has over 30 years of experience in accounting, finance, and taxation and is experienced in a variety of investment fields.Eric Anderson

Eric is a Partner at Scale Venture Partners, where he focuses on investments in cloud infrastructure and security. He is a Board member at Scale portfolio companies Datastax and Upsolver, and a Board observer at Matillion, BigID, Expel, Honeycomb, and AppOmni.

Stacey Bishop

Stacey invests in Intelligent business software. She currently serves on the Board of Directors of Airspace, Demandbase, Extole, Narvar (observer), Textio, and Verusen. Prior board positions include HubSpot (NYSE: HUBS), Bizible (Acq: Marketo), Lever (Acq: Employ), and Vitrue (Acq: Oracle). Stacey also originated investments in Bill.com, ExactTarget, and Omniture.

Jeremy Kaufmann

Jeremy focuses on investments across Scale’s technology portfolio with a primary focus on companies adding machine intelligence to business and vertical software, especially in industries untouched by the first decade of SaaS. His efforts have contributed to investments across vertical software (Motive formally KeepTruckin), AI and automation (Datagen, Flatfile, Cognata, TechSee, and Solvvy), and the intersection of machine learning and digital health (OM1, Proscia, Robin Healthcare, and Viz.ai).Alex Niehenke

Alex joined Scale in 2013 as a Principal, responsible for sourcing investments in DroneDeploy and Forter. A Partner since 2017, Alex has focused on early investments in vertical software markets where incumbents have failed to invest in advanced technology offerings. That thesis has led to investments in Motive formally KeepTruckin (2017), Root Insurance (2018), Scout RFP (2019), Proxy (2020), Spruce (2020), Proscia (2020) and Archipelago (2021), and Dusty Robotics. KeepTruckin has been one of the fastest-growing SaaS companies of all time; Scout RFP was acquired by Workday in late 2019 for $540M; and Root completed its IPO in late 2020.Rory O’Driscoll

Rory has been investing in enterprise software for the past 25 years. An active investor in the rise of SaaS and the wider transition of enterprise computing to the cloud, Rory led investments in Bill.com (BILL), Box (BOX), DocuSign (DOCU), ExactTarget (ET; Acq: SFDC), Omniture (OMTR; Acq: ADBE), Placeware (Acq: MSFT), and WalkMe (WKME) among others. Currently, Rory is focused on investing in business applications powered by AI (cognitive applications), frontier tech, and the continuing adoption of SaaS and cloud.Ariel Tseitlin

Ariel is a Partner at Scale focused on investments in the cloud and security industries. He currently sits on the board of directors at AppOmni, BigID, CyberGRX, Expel, Honeycomb, Human, and Upsolver. Ariel is also a Board observer at Tetrate.Andy Vitus

Andy has been investing with Scale for nearly 15 years and focuses on cloud infrastructure, machine-learning applications, and enterprise software. Andy sits on the boards of CircleCI, Comet, Datagen, Esper, JFrog, Matillion, Observe.AI, PubNub, TechSee, and Unbabel. He was previously on the board of Treasure Data (Acq: ARM) and Stormpath (Acq: Okta).Sam Baker

Sam joined Scale in 2016 and focuses on the firm’s investment in SaaS, vertical software, robotics, and other frontier technology. He was named to Business Insider’s Rising Stars in Venture Capital list and has contributed to the firm’s investments in Dusty Robotics, Locus Robotics, Socure, CyberGRX, OM1, Proxy, and PerimeterX.Chris Yin

Investing in early-stage companies. Chris likes b2b software – apps, infra, and vertical software (healthcare, real estate, insurance, logistics, etc). Can help with the product, gtm, fundraising, and general management.

Dale Chang

Dale is the Operating Partner at Scale. In his role, Dale is a resource for guidance on evolving go-to-market strategies as well as providing best practices and benchmarks across the portfolio.

Kate Mitchell

Kate is a co-founder of Scale, a Silicon Valley-based firm that invests in early-stage enterprise software startups building Cognitive Applications. She and the Scale team have backed successful, high-growth companies including Hubspot (NYSE: HUBS); DocuSign (NASDAQ: DOCU), and Bill.com (NYSE: BILL).Ekaterina Almasque

As a General Partner at OpenOcean, Ekaterina is passionate about breakthrough next-generation technology businesses. For over fifteen years she has been investing in artificial intelligence, data infrastructure, disruptive B2B software platforms, and cybersecurity across the globe, having lived in Silicon Valley, several countries in Europe, and Latin America. Her heart is in creating category-defining technology leaders out of Europe.Patrik Backman

A General Partner at OpenOcean, Patrik’s heart lies with the “data-intensive” bit of our investment thesis. Before starting OpenOcean, Patrik co-founded MariaDB, and spent 6 years managing product and business development at MySQL AB, where he served as a Director of Software Engineering from 2003 to 2008, and managed the company’s strategic technical alliance with SAP AG. With his business hat on, Patrik was part of MySQL Management Team and worked in management consulting at eCraft Management Solutions and A.T. Kearney.Tom Henriksson

Tom is a General Partner at OpenOcean and passionate about data-intensive software that is quick to love and built on strong technology. He is a big believer in accurate consumer profiling, marketing technologies, and intelligent automation of the enterprise. After recently driving strongly profitable exits for OpenOcean in Truecaller, LoopMe, Passfort, and TapDaq, Tom now holds board seats in Cambri, Leadoo Marketing Technologies, Operations1, and Workfellow.Ralf Wahlsten

Ralf is a co-founder and chairman of the board of OpenOcean, Ralf holds board memberships at RapidMiner, Nordic Telecom, and HeavenHR. Before fate brought him together with the rest of the Swedish-speaking Finns in Helsinki to build OpenOcean, he had been an active angel investor, as well as a key advisor to the MySQL founders from the company’s inception, helping them develop their first business plan, strengthening the Board, and hiring the CEO – up until the exit to Sun Microsystems.

BOGOMIL BALKANSKY

The logical domains for BOGOMIL BALKANSKY are cloud infrastructure, developer tools, DevOps, open source, observability as well as SaaS apps for sales and marketing, because that’s where his background is. But he tries to follow the advice several of his partners gave him when he first joined Sequoia—don’t specialize too narrowly, and get out of your comfort zone.ROELOF BOTHA

The unconventional. So many times, I’ve led an investment and been made fun of. YouTube. Instagram. MongoDB. There’s a little defiance in saying, “We’ll show you!” I remember in 2001 when I was at PayPal, there was an article titled “Earth to Palo Alto.” It said we were deranged, we didn’t know what we were doing. In the meantime, I was inside the building, knowing that we were months away from being profitable and on our way to being a public company.KONSTANTINE BUHLER

First and foremost: integrity, honesty, and directness. The best policy is always the honest policy. The best founders also have determination, persistence, and grit. If you persist, you will succeed. Most of my founders see me as more than an investor and even more than a friend. I take the role of “partner” to my founders very seriously, through thick and thin.JOSEPHINE CHEN

I want to dream with founders. Many times investors miss the seemingly simple ideas that can transform the future that visionary founders are able to see. I meet with entrepreneurs all day, but learning about each person’s journey and insights never gets old. The best conversations are the ones that continue until 4 AM because we are riffing on each other’s ideas. I want to be able to dream with you.BILL COUGHRAN

The companies that interest me the most are companies creating solutions to technical problems that can change markets. I’ve always been drawn to creative problems and people with a technical point of view—networking, security, machine learning, and AI, to name a few.JIM GOETZ

The collision of ambition and intelligence is the foundation. A modern business model is part of the ante. An ability to develop culture and magnet qualities for talent are wonderful soft skills. Prior success leading an organization or honing your skills at another great startup is a fantastic path to entrepreneurship.JESS LEE

Consumer is my natural habitat. The greatest consumer companies fundamentally change the way we live or work, so I pay close attention to generational shifts like the rise of the side hustle, the aging population, Gen Z attitudes, and the future of flexible work. Some of the great consumer ideas seem crazy at first. When you start, most people think, “That will never work.” And then it works.DOUG LEONE

Performance. Do you bring it every day? You can’t always be at 110%, but when it’s playoff time the great players know how to bring it. You have to take as many people along with you for the ride. Teams always beat individuals. I love founders who are spiky, in any dimension. It’s never about money but about doing something meaningful. They do the impossible and you have to learn to dream with them while helping them to build a business. We have a culture of taking risks. I prefer you take a shot. I’d rather have someone who gets A, F, F, A than someone that gets B+, B+, B+, B+. I prefer people who ask for forgiveness rather than for permission. You have to be willing to put yourself out of business by trying new things before someone else does.ALFRED LIN

I am much more focused on the founders’ special characteristics, their novel, and unique insights, the eureka moment of their founding story, and their lived experiences that creates empathy for the customer they will serve. Basically, I am on the lookout for a founder-market fit. After you strip through all that, there is only one criterion for me: would I love to work for the founders and help them reach their and their company’s full potential? It is our job as partners, not just investors—to work for the founders.LUCIANA LIXANDRU

When I started investing, I didn’t fully understand people who said it was all about the founder. My first questions were always about business models and markets. But over the years, I’ve come to turn that around, and I now make more investments than ever at the seed, when the founding team is all that matters.SHAUN MAGUIRE

I like high-IQ founders. But even more important to me is someone that’s just irrationally motivated. For whatever reason, it’s their life mission to try to revolutionize the industry they’re going after. And some of these founders don’t even understand where it comes from, or how deeply ingrained it is in them. I’ve got to believe that they work incredibly hard in part to make their families proud. In some cases, they were wildly misunderstood as kids and had chips on their shoulders. One of the ways to measure this is, what do people do on their weekends? The best founders are just so obsessed with what they’re doing that they cannot turn off.MICHAEL MORITZ

Curiosity. People who speak in complete sentences about a topic that absorbs them. When we first get involved with a tiny company, nothing is obvious. If you’re looking for certainty, you wind up with bores engaged in mundane activities. We have a fondness for obsessives on a mission. This was the case when we met the founders of what became Yahoo!, PayPal, Google, Klarna, and Stripe and we hope it’s true when we meet you.LAUREN REEDER

Data and infrastructure is a place I’ve spent a lot of time and I think is fascinating. There is so much that goes on behind the scenes in both of these areas. I’m also curious to learn more about climate tech. It’s clear we need to do something for the planet, but it’s not just that—there are also great businesses to be built.GEORGE ROBSON

The world’s first trillionaire will either be in climate, or in crypto. Zero-carbon concrete—somebody needs to solve that problem. It’s not sexy, but it would give us more time to solve everything else. In crypto there is a unique opportunity to rewrite pillars of our financial system; enabling people to share digital assets across borders instantly for free and promoting greater interoperability of both data, assets, and global liquidity. It has the capacity to be an important leveler for people to participate in the financial system, wherever they are.BRYAN SCHREIER

We try not to specialize. Any company with the ability to somehow rewire an industry is compelling to me. When we met Drew Houston and Arash Ferdowsi in 2007, it was just the two of them, working in a tiny Russian Hill apartment. After one pre-launch demo, it was clear to us that they had the vision and the skills to make Dropbox the center of people’s digital world.MIKE VERNAL

The two things I know best are consumer products and developer products. I spent about half my career doing each. I spent a lot of my career designing APIs, developer tools, and documentation. Nowadays, I gravitate most to products whose fundamental goal is to connect people.STEPHANIE ZHAN

Most important is working with good people I want to spend time with for decades. Founders who have the ambition to build something lasting and transformational. Founders who are thoughtful, gritty, and have the mental and emotional fortitude to charge ahead and lead even through tough times. In consumer, I love products that bring joy, convenience, accessibility, community, and belonging. On the enterprise side, it’s an incredible field of opportunity right now. I love products that focus on bringing a delightful user experience, easier and faster collaboration, and greater productivity and efficiency. Finally, AI will be the most important theme of the next decade, driven by the scale of data, new technological breakthroughs in generative models, and advancements in computing.MICHELLE BAILHE

ANAS BIAD

I like spending time in different areas. If a business has the potential to disrupt how we live and work, I’m excited to learn about it. Every founder is different, but they all have a story of why they decided to drop everything and start their company. I look for founders who have unique insight and are obsessed with winning.ISAIAH BOONE

CARL ESCHENBACH

I’m a specialist, not a generalist. It’s great to learn something new—like being on the board of a self-driving vehicle company—and my partners have taught me a lot about things like consumer apps and crypto. But anything associated with infrastructure, SaaS, cloud, and selling into the enterprise, or building businesses bottoms up are very much my sweet spots.PAT GRADY

People at Sequoia have very different backgrounds and views of the world, but we work well together because we all want to help founders make a dent in the universe. We believe in the power of storytelling, and in the stories we tell the founders are the heroes. Every founder deserves a tremendous amount of respect for having the courage and vulnerability to start something—to ignore reason in pursuit of a dream. I’ve never had the guts to do that. Supporting founders on the epic journey of a startup is an honor and a responsibility we don’t take lightly.RAVI GUPTA

I have been lucky to be involved in companies across industries—consumer and enterprise, fintech, and crypto. More than anything, what I look for is someone I want to talk to at 10:30 at night if they have a problem. Instacart gave me empathy for the ups and downs. It is so easy to say what somebody should do—and so hard to do it. Businesses are not numbers on a page. They are a collection of people going after a shared mission.DANNIE HERZBERG

I’m interested in the future of work, SMB SaaS, and any company that grows through a self-service and community-driven motion. Beyond this, I’m compelled by founders who are so passionate about the problem that they’re solving that their enthusiasm is contagious. A founder that’s a good fit for me is someone who is clear on the company’s vision and relentless in pursuit of its mission.SONYA HUANG

These days, I spend a lot of time in fintech and software, seeking to find companies reinventing legacy financial services and enterprise technology in a design-first, user-first way. I’ve also been spending more time in Latin America and am blown away by the scale of the founder’s ambition.KAIS KHIMJI

I try to look for entrepreneurs who can’t fathom themselves as anything else. I focus on three main things: IQ, EQ, and HQ (hunger quotient). Some of the best founders have all three—and know how to call their shots.MATT MILLER

The thing I really love about Sequoia is that we approach investing with an eye to become the founder’s preferred business partner and to dream with them on a scale of decades. We work to give every company we partner with every unfair advantage we can, from our own depth of experience and network. That is how we spend half of our time and it’s one of the most thrilling aspects of our jobs.ANDREW REED

First, and most important is the founding team. Regardless of the stage, that’s where everything starts. I look for people who have the horsepower to solve hard problems, the determination and ambition to build an enduring company for the long term, and the ability to explain a future and make it seem inevitable. I also look for people I trust. The best founders—when given the right set of inputs—tend to make the right decisions. Our job is to make sure those inputs are there.Nina Achadjian

Nina focuses on venture and growth investments in enterprise SaaS, vertical SaaS, and AI. She is excited by the combination of software and payments to help legacy industries transition from using pen-and-paper workflows to adopting more modern, vertical-specific solutions. Nina also believes that the combination of voice and AI is unlocking new business applications and soon will become the new system of record for enterprises. In 2022, she was featured on the Forbes Midas Brink List, which recognizes up-and-coming leading investors.

Chris Ahn

Chris started his career at Morgan Stanley and later joined Hellman & Friedman, an investment firm with over $80 billion AUM. It was there that he discovered open source, which led him to join GitHub in 2015. At GitHub, Chris was involved in numerous initiatives, including helping to start and lead the Strategic Finance and Business Operations teams, creating the company’s first operating plan, helping to scale the sales team, launching the marketplace product, and leading the acquisition with Microsoft. After the GitHub acquisition, Chris became a Partner at Index Ventures to invest in the next generation of community-led businesses. He helped sponsor Index’s investments in Notion and Figma and later spearheaded their crypto efforts, including their investment in Fireblocks.Molly Alter

Molly focuses on seed, venture, and growth investments across enterprise SaaS, with a particular focus on Vertical Software and Health-tech. She loves figuring out how opaque industries operate and admires entrepreneurs who roll up their sleeves and make complex processes simpler.

Julia Andre

Julia joined Index in 2019 to focus on B2B Saas and Fintech across Europe. She is especially interested in businesses that increase transaction efficiency and enable retail and business commerce to shift digitally.

Damir Becirovic

Index Ventures in 2015 and invests in application software companies serving consumers (B2C) and businesses (B2B).

Prior to Index, Damir was at Goldman Sachs, where he worked on M&A and capital markets transactions for consumer/retail, healthcare, and cleantech companies, as well as at Coatue, where he was involved with the firm’s investments in Lyft and Avvo. Damir has also worked at Activision Blizzard, Apple, and Flextronics.

Sofia Dolfe

Sofia partners with founders who leverage their unique perspectives, and personal understanding of a problem, to create businesses that lead to behavioral shifts, powerful network effects, and the reshaping of entire industries, from grocery and e-commerce to financial services and healthcare.

Mark Fiorentino

Mark leads investments focusing largely on fintech and application SaaS. He is especially interested in fintech infrastructure, verticalized payment workflows, and SaaS tools disrupting legacy incumbents. Mark is the board member or lead investor from Index in a number of companies including RevenueCat, Mercantile, and Catch.

Mark Goldberg

Mark joined Index in 2015 and leads investments across fintech and software, from seed to pre-IPO stages. He is the board member or lead investor from Index in Plaid, Persona, Lithic, Pilot, Motive, Built, Pave, Intercom, and many others. He has been featured or quoted in the New York Times, Bloomberg, TechCrunch, The Economist, and other publications. Before becoming an investor, Mark was an early employee on the business team at Dropbox and helped the company grow tenfold during his tenure there.Carlos Gonzalez-Cadenas

Carlos joined Index as a partner in January 2021 to focus on SaaS, Open Source, Security, Financial Services, AI, and Infrastructure/DevOps. Most recently, Carlos was the COO, and before that CPO and CTO, of UK-based fintech, GoCardless. He is an angel investor in more than 60 companies including Codat, cargo.one, Hopin and Shapr3D, and serves as a board director at GoCardless.

Jan Hammer

Jan joined Index in 2010, after working as an investor at General Atlantic and an investment banker at Morgan Stanley. With a focus on data and financial services, Jan has a track record of spotting young companies that will go on to reshape the workings of the digital economy at its very deepest level. Jan was an early-stage investor in Adyen, which IPO’d in 2018, and in Robinhood and Wise which both floated in 2021. Other companies in his portfolio include Alan, Collibra, Capitolis, and SafetyCulture. He is ranked first in Europe on the Forbes Midas List for four years in a row and among the top 15 on Forbes’ global list.Stephane Kurgan

Stephane joined Index in 2020 as a venture partner after three decades as an operator in senior roles in European tech businesses. He focuses on supporting entrepreneurs with a strong belief in purpose-driven leadership. Prior to joining Index, Stephane was the chief operating officer of King Digital Entertainment (KING), the maker of Candy Crush Saga. He was part of the team that oversaw its $7B IPO – one of the largest for a European tech company at the time – and subsequent acquisition by Activision Blizzard. Prior to King, Stephane worked across almost every business function in a variety of European tech companies, including sales, product, finance, and senior management. He has also been a consultant at McKinsey & Co.Martin Mignot

Martin invests in products that leverage new technologies to save time and money for people and companies while improving with every new user that engages with them. Martin established Index’s New York office in 2022, moving from London to help European founders and companies launch in the US, as well as guide those expanding from America to Europe. He is deeply passionate about early-stage companies, and since joining Index in 2010, has helped the likes of Deliveroo, Captain Train/Trainline, and Drivy/Getaround on their journey from seed to IPO, as well as other European breakout successes like Personio, Revolut or Swile from their early days.Jimena Nowack

Jimena focuses on early-stage and growth investments across B2C and B2B. She is particularly passionate about Climate Tech start-ups across a variety of business models, software applications disrupting legacy consumer-facing industries, SME tools, marketplaces and e-commerce infrastructure.Prior to joining Index, Jimena worked at General Atlantic in London, where she focused on consumer internet opportunities. Before that, she began her career in M&A at Lazard.

Bryan Offutt

Bryan joined Index in 2018 and focuses on enterprise investments with an emphasis on design. He is particularly interested in the consumerization of enterprise and the use of design to improve the approachability of highly technical products.

Erin Price-Wright

Erin is an early-stage technology investor focused on enterprise software and AI, with an emphasis on data, infrastructure, security, and automation. She is especially interested in products and technologies that increase resilience, foster collaboration and creativity, and support data-driven decision-making throughout organizations.

Danny Rimer

Danny Rimer is an investor and partner at Index Ventures. He opened the firm’s London office in 2002 and the San Francisco office in 2012, before returning to London in 2018. He has been ranked by Forbes as one of the world’s top investors for over a decade. Danny has always been drawn to working with founders who share his passion for the power of design and his fascination with the intersection of technology and culture. This has informed investments in Figma, Dropbox, Discord, Etsy, Farfetch, Glossier, Patreon, and many more.Neil Rimer

Neil co-founded Index Ventures in 1996 and served as a Partner for more than 25 years. In 2021, Neil stepped down as an active Partner. Since then, he has continued to manage his portion of the portfolio and makes himself available to support his partners and the firm he helped build. As an investor and a founder, Neil has played a seminal role in nurturing the tech ecosystem in Europe and beyond.Hannah Seal

Hannah joined Index in 2016 after a successful career as an e-commerce operator. She is fascinated by the future of work and has been an early and consistent champion of Europe’s B2B software sector. Hannah is passionate about helping visionary entrepreneurs from day one, and supporting them as their companies scale and grow. She is particularly energized by founders who have an unfair advantage in tackling daunting problems in technical or challenging markets. Her investments for Index include Remote.com, a platform to enable distributed working; Multiverse, the company bringing apprenticeships into the digital age; Fonoa, the automated tax platform; and Beauty Pie, the online cosmetics and beauty subscription service.

Shardul Shah

Shardul joined Index in 2008. He focuses on security, cloud infrastructure, and enterprise software. He is a director or observer of Attack IQ, Brightback, Castle Intelligence, Coalition, Datadog (NASDAQ: DDOG), Evervault, Expel, Gatsby, and Wiz. Shardul was previously a director of Adallom (Microsoft), Sourceclear (CA Technologies), Koality (Docker), Lacoon (Check Point), Base (Zendesk), Iterable, and an investor in Duo Security (Cisco). After graduating from the University of Chicago, Shardul worked with Summit Partners where he focused on healthcare and internet technologies.Georgia Stevenson

Georgia joined Index in 2019 and focuses on consumer and retail investments across Europe, with a particular interest in marketplaces, consumer social & e-commerce infrastructure. Prior to joining, Georgia worked at Northzone where she focused on early-stage opportunities across B2B and B2C sectors in the UK.

Kelly Toole

Kelly was a former partner at Index Ventures and focuses on Artificial Intelligence (Ai) and Machine Language (ML). Kelly is now a product manager at Clock House.

Mike Volpi

Mike joined Index in 2009, to help establish the firm’s San Francisco office with Danny Rimer. Mike invests primarily in infrastructure, open-source, and artificial intelligence companies. He’s currently serving the boards of Aurora, Cockroach Labs, Confluent, Covariant.ai, Elastic, Kong, Sonos, Starburst, and Wealthfront. Mike was previously a director of Blue Bottle Coffee, Hortonworks, and Zuora.

Katharina Wilhelm

Katharina invests in companies in Germany, Austria, and Switzerland, ranging from pre-seed to pre-IPO.

Prior to joining Index, Katharina was an investor at Cherry Ventures where she invested in enterprise and productivity software as well as consumer propositions. She started her career at The Boston Consulting Group in Zurich.

Rex Woodbury

Rex focuses on early-stage and growth investments in consumer technology businesses. He’s particularly interested in online communication, Gen Z, commerce, marketplaces, and the future of work.

Pranav Pai

Pranav Pai is the Founding Partner and Chief Investment Officer at 3one4 Capital. Pranav leads investments and portfolio construction at 3one4Capital. As CIO, he has led over 70 seed and venture capital investments across several investment categories in India and the US. Pranav is deeply involved with the startup ecosystem in India. He served as the Co-President of Stanford Angels and Entrepreneurs India and the National Vice Chairman of the All India Management Association’s (AIMA) Young Leaders Council.Siddarth Pai

Siddarth Pai is the Founding Partner, CFO, and ESG Officer of 3one4 Capital. Siddarth is the youngest Executive Council member of the Indian Venture Capital Association (IVCA) – the apex body for Indian funds investing in alternative assets. He also serves as the Co-Chair of the Regulatory Affairs Committee, working on matters related to security markets, Alternative Investment Funds, taxation, foreign exchange, law, and startups.Anurag Ramdasan

Anurag Ramdasan is Partner at 3one4 Capital and heads Investments at the firm. As an intrinsic part of 3one4 Capital since its inception, he has built a highly dynamic and flexible investment strategy to go along with the hyper-growth of the firm. He has been deeply involved in directly investing and managing over 30 of the 70+ strong portfolio companies at 3one4 Capital including one of India’s largest social networking platforms (Koo), a multi-brand tech-enabled distributor (Ripplr), a distributed personal finance platform for small town India (WeRize), a hyper-local social content platform (Lokal), among others. Under Anurag’s tenure at 3one4 Capital, the firm saw a scale-up to over 5000 deals a year consistently and has been giving top decile returns consistently. In addition to leading investment strategies and strengthening portfolio management across funds, Anurag also supports the expansion of 3one4 Capital’s stage focuses and the team as the firm continues to scale its AUM.STEVE ANDERSON

Driven by an avid love for effecting change, and my diverse experience from eBay, Microsoft, Kleiner Perkins, Starbucks, and Digital Equipment Corporation, I founded Baseline to address the gap between individual investors and institutional venture capitalists. Baseline Ventures has invested in more than 100 companies, with founders and investors alike exiting profitably from over 50. I am fortunate to be included on the Forbes Midas List from 2015 to 2020, an annual ranking of the best venture capital firms in tech.Mike Maples

Mike Maples is a co-founding Partner at Floodgate. He has been on the Forbes Midas List eight times in the last decade and was also named a “Rising Star” by FORTUNE and profiled by Harvard Business School for his lifetime contributions to entrepreneurship. Before becoming a full-time investor, Mike was involved as a founder and operating executive at back-to-back startup IPOs, including Tivoli Systems (IPO TIVS, acquired by IBM) and Motive (IPO MOTV, acquired by Alcatel-Lucent.) Some of Mike’s investments include Twitter, Twitch.tv, Clover Health, Okta, Outreach, ngmoco, Chegg, Bazaarvoice, and Demandforce.Ann Miura-Ko

Ann Miura-Ko is a co-founding Partner at Floodgate. A repeat member of the Forbes Midas List and the New York Times Top 20 Venture Capitalists Worldwide, Ann was also named the “Most Powerful Woman in Startups” by Forbes. Ann is well-known in Silicon Valley as a pioneer investor in highly technical companies because of her background as a Ph.D. in math modeling of infosec at Stanford. Her deep interest in technology began as a child – her father was a NASA rocket scientist – and her expertise developed as an undergraduate at Yale, where she participated in the Robocup Competition in Paris, France. Ann has also made significant investments in consumer (commerce, curation), marketplaces, and software for SMBs and solopreneurs. Some of Ann’s investments include Lyft (where she is still a board member), Xamarin, Monthly, Popshop, Emotive, and Refinery29.Iris Choi

Iris Choi is a Partner at Floodgate. She drives corporate relationships and works closely with portfolio companies on a range of strategic areas, including business development and financing. Before Floodgate, Iris spent 10 years in investment banking.Arjun Chopra

Arjun Chopra is a Partner at Floodgate. He leads the firm’s investments in opportunities that transform the “IT stack” in ways that help companies change the way they do business and compete. Before Floodgate, Arjun was the CTO at Cambridge Technology Enterprises (CTE), a publicly traded cloud services company, where he launched and led their cloud business. He was a member of the board and executive team that raised multiple rounds of financing. He led 350+ people, managed 200M hours of uptime in the public cloud, and was recognized as one of Amazon Web Service’s top 22 partners worldwide. Arjun joined CTE when they acquired Vox Holdings, the open-source startup he founded.Joël Jean-Mairet

Joël oversees all operations at Ysios Capital, including management, strategy, and day-to-day operations. Previously, in 2001, Joël co-founded Glycart Biotechnology and was its CEO until its sale to F. Hoffmann La-Roche four years later. Glycart Biotechnology was the originator of the anti-CD20 antibody – obinituzumab/Gazyva® – the first breakthrough designated drug approved by the FDA in 2013. Joël was elected one of the 50 key players in biotechnology in Switzerland in 2003 and earned several innovation awards for Glycart Biotechnology, including the Wall Street Journal Europe Innovation Award in 2001.Julia Salaverría

Julia is responsible for investor relations and corporate development and management at Ysios Capital. Julia has over 25 years of experience in executive positions in the financial sector. From 2000 to 2007, Julia was Director at Talde – a venture capital group that pioneered venture capital management in Spain. There she was responsible for fundraising and investor relations and for Talde’s biotech investments in Spain. Julia led the closure of a €40 million fund for Talde in 2000 and was responsible for raising another fund of €60 million in 2006.Karen Wagner

Karen focuses on therapeutic investments at Ysios Capital, and coordinates the identification and evaluation of investment opportunities. Karen joined Ysios in 2008 with more than 10 years of experience in business development for various biotech and pharma companies. She started her career as a management consultant in McKinsey & Company’s global healthcare practice and was subsequently Director of Business Development at Ingenium Pharmaceuticals.Cristina Garmendia

Cristina supports institutional relations at Ysios Capital, both in Spain and abroad, as well as investor relations and fundraising. Cristina has extensive public policy and consulting experience. She served as Minister for Science and Innovation of Spain from 2008–2011. She led some of the most ground-breaking reforms ever made in this area, including the Spanish Innovation Strategy and the Law for Science, Technology, and Innovation, and the restructuring of major government funding programs and agencies. During her tenure, Cristina also forged key international agreements, particularly during the Spanish Presidency of the Council of the European Union in 2010.Paula Olazábal

Paula monitors Ysios Capitals’ portfolio companies and is responsible for reporting to the investors of Ysios’ funds. She is also in charge of evaluating investment opportunities from a financial and legal perspective. Before joining Ysios in 2008, Paula worked in leading investment banks in Spain (Alantra and Sabadell Corporate Finance). Throughout her career, she has been involved in several buy and sell processes of companies in different sectors.Raúl Martín-Ruiz

Raúl oversees and coordinates the identification and evaluation of investment opportunities from both scientific and business perspectives at Ysios Capital. Prior to joining Ysios in 2008, Raúl first worked in corporate business development (Licensing In and Licensing Out) at Laboratorios Almirall. He was subsequently responsible for developing and managing the business of the Company in the Americas and Africa through licensees and distributors.Guillem Laporta

Guillem is responsible for identifying and evaluating investment opportunities at Ysios Capital. Guillem has over 10 years of venture capital experience. Prior to joining Ysios, he worked at the Edmond de Rothschild Group in Paris (now Andera Partners). There he was involved in the execution of several investments in Europe and the United States, including successful companies such as Reviral (sold to Pfizer), Axonics Modulation (Nasdaq: AXNX, $3B market cap), and Sanifit (sold to Vifor).Aydin Senkut

An original super angel turned multi-stage investor, Aydin has been named on the Forbes Midas List for the past nine years (2014-2022) as well as the New York Times Top 20 Venture Capitalists list for four consecutive years (2016-2019). Before starting Felicis, he was the first product manager at Google and helped launch their first ten international sites.Grace Chou

Grace brings more than a decade of experience as a builder and investor. She has been named to Forbes 30 Under 30, as well as Wall Street Journal’s 10 Women to Watch in Venture Capital. She is an early-stage investor at Maveron where she partners with entrepreneurs to build the next generation of iconic platforms reimagining the way we live, work, create, and thrive. Prior to Maveron, Grace was a principal at Felicis Ventures, where she partnered closely with more than a dozen entrepreneurs.Jake Storm

Jake Storm is a Deal Partner at Felicis. Prior to joining Felicis, Jake was an investor at IVP where he partnered with companies ranging from Papaya Global in global payroll to Lyra Health and Whoop in digital health to CircleCI in infrastructure software. Preceding IVP, Jake spent several years across investment banking at Jefferies and enterprise software sales at Qualtrics and Zuora.Niki Pezeshki

Niki works closely with Felicis’ investments in companies such as Guild, Trusted Health, and Popmenu. Before joining Felicis, Niki was an investment team member at Summit Partners and Vista Equity Partners, and he also worked at the Climate Corporation in sales strategy and operations. Niki holds a BS in Business Administration with Honors from the University of Southern California and remains involved with the USC Value Investing Group.Ryan Isono

Ryan Isono is a Deal Partner at Felicis. At Felicis, Ryan has sourced and works closely with the firm’s investments in Ethena, n8n, and Stream. Prior to joining Felicis, Ryan was part of the investment team at Correlation Ventures, a data-driven venture capital fund in San Francisco, and Revel Partners, a New York-based venture capital fund focused on B2B software. Before Revel, Ryan worked in investment banking at Credit Suisse’s New York office.Sundeep Peechu

As a General Partner and founding member of Felicis, Sundeep led Felicis’ investments in several companies such as Coalition, Plaid, and Komodo Health, as well as the following companies that have gone public: Ginkgo Bioworks, Matterport, Recursion Pharma, and Wish.Victoria Treyger

As a General Partner at Felicis, Victoria is focused on the reinvention of financial services, vertical and horizontal SaaS, health tech, and marketplaces. Victoria’s angel investment and advising track record includes Roadie (acquired by UPS), Faire, Roofstock, Betterment, ZocDoc, and Galileo Health. Previously, Victoria served as Chief Revenue Officer of Kabbage (acquired by American Express), where she was responsible for building the company’s revenue and go-to-market teams, resulting in nearly $300 million in revenue after six years of 100%+ annual growth.Viviana Faga

An experienced angel investor, Viviana previously served as an operating partner and advisor at Emergence Capital. Viviana is a General Partner at Felicis, bringing over 20 years of experience designing and building brand categories for successful cloud/SaaS and enterprise social companies. Her expertise includes scaling go-to-market SaaS teams, messaging and positioning, category creation, freemium product strategy, and sales enablement.Wesley Chan

Wesley Chan is a Venture Partner at Felicis where he led investments in more than 35 companies. He founded Google Analytics and Google Voice and holds 17 US patents for his foundational work in designing Google’s ads system. Wesley is an early investor and a coach or board director in a large number of well-known billion-dollar “unicorn” startups: Canva, Gusto, Guild Education, Orca Bio, Flexport, Plaid, Checkr, Carta, Credit Karma, Zipline, RobinHood and Ring (exit to AMZN). Wesley also invested and led rounds in CultureAmp, TrialSpark, Dialpad, Turvo, HelloSign (exit to DBX), HyperScience, Whole Biome, ProteinQure, Astranis, Okera, Ascend.io, Overture Life, TopFunnel, Spring Discovery, Juvena Therapeutics, Skip the Dishes (exit to Just Eats/JE), and YES (exit to TWTR). Wesley was previously a General Partner at GV (formerly Google Ventures), where he built the investment team, and held board or observer seats in Angelist, Aptelligent (exit to VMW), iPerian (exit to BMS), and Dialpad. Wesley led the seed investing program and was among the first checks into Plaid, RobinHood, Vungle ($750M exit to Blackstone), Gusto, Optimizely, DataPad (exit to Cloudera), Freshplum (exit to TWTR), Namo Media (exit to TWTR), and Parse (exit to FB).Aimee He

Aimee used to be a partner at Meritech. Thereafter, moved to Retool.Alex Clayton

Alex joined Meritech in 2020 and helps lead the firm’s enterprise software, infrastructure, and fintech practices.

Prior to Meritech, Alex was a partner on Spark Capital’s Growth Fund where he primarily focused on enterprise software and infrastructure investments. He was responsible for the firm’s investments in Braze, JFrog, Justworks, Outreach, Pendo and Tray.io. Prior to Spark, Alex worked at Redpoint Ventures where he sourced or was actively involved in the firm’s investments in Duo Security (CSCO), Justworks, RelateIQ (CRM), Lifesize, and Sourcegraph.

Alex Kurland

Alex joined Meritech in 2018 and helps lead the firm’s enterprise software and infrastructure practices.

Prior to Meritech, Alex spent six years at Kleiner Perkins, where he led the Digital Growth Fund’s enterprise practice. He was responsible for the firm’s investments in CloudHealth (VMW), DoorDash, Looker (GOOG), Ring (AMZN), Slack (WORK), and UiPath (PATH). Prior to Kleiner, Alex worked at Summit Partners, where he was responsible for sourcing and executing technology growth equity investments across enterprise software, consumer Internet, and education services.

Anthony DeCamillo

Anthony joined Meritech in 2019 and focuses on enterprise applications, infrastructure, and consumer.

Prior to Meritech, Anthony spent three years at Allen & Company, where he focused on media, enterprise software, and consumer internet companies.

Ashley Paston

Ashley joined Meritech in 2022 and focuses on fintech, enterprise software, and marketplaces. Prior to Meritech, Ashley spent four years at Bain Capital Ventures, where she was responsible for sourcing and executing early-stage and growth equity investments across fintech, enterprise software, and marketplaces, investing in companies such as SmartRent (SMRT), Pleo, GoCardless, Material Bank, Autoleap, Orum, Finix, and Moov.

Craig Sherman

Craig joined Meritech in 2011 and invests in consumer and healthcare.

Craig’s Meritech and personal investments include Roblox (RBLX, 10x Genomics (TXG), Zillow (ZG), SurveyMonkey (SVMK), Zipcar, Zulily, GoFundMe, Grand Rounds, Bright, Health, Niantic, Wealthsimple, Self, Everlane, Lynda.com, Rev.com, Ancestry.com, and many more. Before joining Meritech, Craig was an entrepreneur and independent board member (8 boards).

George Bischof

George joined Meritech in 2008 and helps lead the firm’s enterprise software, infrastructure, and cybersecurity practices.

Prior to Meritech, George spent eight years as a General Partner with Focus Ventures where his investments included Barracuda Networks (CUDA), EqualLogic (DELL), Extricity (PRGN), G-Log (ORCL), Isilon Systems (EMC), QuinStreet (QNST) and Wily Technology (CA).

Max Motschwiller

Max joined Meritech in 2015 and helps lead the firm’s consumer, fintech, and enterprise software practices.

Prior to Meritech, Max spent three years at Kleiner Perkins, where he was responsible for the firm’s investments in Dropcam (GOOG), Duolingo, MyFitnessPal (UAA), RelateIQ (CRM), Stance, and Uber (UBER). Prior to Kleiner, Max worked at Summit Partners, where he was responsible for sourcing and executing technology growth equity investments across enterprise software and consumer internet.

Paul Madera

Paul co-founded Meritech in 1999 and helps lead the firm’s consumer, enterprise, and fintech practices.

Prior to co-founding Meritech, Paul was a Managing Director and the Head of the Private Equity Group at Montgomery Securities, where he advised private tech companies on equity financings.

Rob Ward

Rob co-founded Meritech in 1999 and helps lead the firm’s infrastructure, application software, and data & analytics investment practices.

Rob has been named to the Forbes ‘Midas List’ multiple times, a recognition given to the world’s top tech investors.

Rishi Garg

Rishi focuses on consumer investments, after a career helping build many great consumer platforms. As Global VP of Corporate Development and Strategy at Twitter, Rishi executed its most active M&A program, including the acquisitions of Periscope, TellApart, Niche, Zipdial, and others, greatly expanding Twitter’s technology and product platform. As an early executive at Square, Rishi was the first Head of Corporate Development and earlier, served as Head of Strategic Partnerships, working across the company on a wide range of M&A and business development projects during the company’s hyper-growth phase. Earlier, Rishi co-founded FanSnap, a leading venture-backed live event ticket search company acquired by Nextag. He also served in impactful Business Development roles at Google and MTV Networks. Rishi has been a personal investor and advisor to several companies including Opendoor, Netsil/Nutanix.

Arvind Gupta

Arvind Gupta focuses on investments in Human & Planetary Health, where his mission is to invest in science-based companies that could change history. Ranging from reinventing our food system to stopping climate change to novel therapeutics, Arvind was the first investor in breakout companies such as Geltor, Synthex, Prime Roots, NotCo, Prellis, New Culture, DNA Lite, Catalog, Prellis, and Memphis Meats. As Founder of IndieBio, Arvind redefined the pace and possibilities of early-stage biotech, investing in over 136 companies in five years, defining human and planetary health, and growing the IndieBio portfolio into billions of dollars in value.Tejas Maniar

Tejas Maniar partners with entrepreneurs to champion their pursuit of disruptive ideas. He invests in people who relentlessly seek out challenges, and opportunities to learn. Tejas serves as Operating Partner and also leads Mayfield’s talent function. Tejas is a proven operating executive. At Mayfield, he partners closely with companies on their strategies for leadership, hiring, and human capital. He serves as a board observer on SmartRecruiters, Skilljar, and Mammoth Biosciences.Ursheet Parikh

Ursheet Parikh’s investments in the enterprise sector include Versa Networks (Security and SD-WAN), Qwiet (Application Security), Rancher Labs (Cloud Computing platform acquired by SUSE), CloudGenix (SD-WAN platform acquired by Palo Alto Networks), and Netsil (Application Observability platform acquired by Nutanix). Ursheet’s investments in human & planetary health include Mammoth Biosciences (CRISPR), Mission Bio (Single Cell Sequencing, Oncology), Qventus (Healthcare AI), Endpoint Health (Precision Immunology), Mirvie (predict and prevent pregnancy complications for moms and babies), GraphWear (Continuous Non-invasive Glucose Monitoring), Chemix (AI-powered next gen EV battery technologies) and Foodsmart (reverse metabolic disease).Patrick Salyer

Patrick invests in the enterprise sector, focusing on middleware and API businesses. He believes people matter most, and his investment philosophy starts with building trusted relationships with founders. He helps entrepreneurs by coaching them on the CEO growth journey, company building, and go-to-market strategy. Patrick brings more than a decade of enterprise leadership experience to Mayfield. He is the former CEO of Mayfield portfolio company Gigya, a customer identity and access management leader, which was acquired by SAP. As a first-time CEO who built Gigya into a successful enterprise company, he brings a company-building playbook that can serve as a model for entrepreneurs.Rajeev Batra

Rajeev Batra is an experienced investor and former enterprise software entrepreneur and executive. He focuses on investments in Cloud and SaaS and engages deeply with entrepreneurs in company building from the earliest stages. He was an Entrepreneur and Operator of living and breathing Enterprise Software before entering Venture Capital. At Mayfield, he has had a front-row seat to the trend of SaaS growing from systems of record to systems of engagement/action, by partnering with the founders of industry-leading companies such as Marketo, Outreach, ServiceMax, SmartRecruiters, Crunchbase, Skilljar, and WideOrbit.Navin Chaddha

Navin leads Mayfield as Managing Director. Under his leadership, Mayfield has raised six U.S. funds and guided over 80 companies to positive outcomes. He has been named a Young Global Leader by the World Economic Forum and has ranked on the Forbes Midas List of Top 100 Tech Investors fifteen times, including being named in the Top Five in 2020, 2022, and 2023. Navin’s investments have created over $120 billion in equity value and over 40,000 jobs. During his venture capital career, Navin has invested in over 60 companies, of which 18 have gone public and 27 have been acquired. Navin was one of the earliest Silicon Valley investors to leverage the promise of tech in India.Tim Chang

Tim focuses on consumer investments. Tim’s venture capital experience includes leading investments at Norwest Venture Partners and Gabriel Venture Partners. His operational experience includes working in product management and engineering across Asia for Gateway, Inc., and General Motors. Tim holds an MBA with honors from the Stanford Graduate School of Business, and an MS and BS in Electrical Engineering/System Engineering from the University of Michigan.Joanne Chen

Joanne invests in early-stage AI-first B2B applications (“self-driving companies”) and data platforms that are the building blocks of the automated enterprise. She has shared her learnings as a featured speaker at conferences including CES, SXSW, WebSummit, and has spoken about the impact of AI on society in her TED talk “Confessions of an AI Investor.”Angus Davis

Angus Davis has been an active entrepreneur, executive, and investor in the Internet industry since its commercialization. Angus then co-founded Tellme Networks, to bring the power of the internet to the phone. BusinessWeek named Angus one of the “Top Ten Entrepreneurs Under Age 30.” In 2009 he founded Upserve in Providence, Rhode Island, where as CEO he grew to become one of the largest cloud-based point-of-sale platforms for full-service restaurants in the U.S., with over 10,000 restaurant customers and a payments platform processing over $12 billion in annual volume. Forbes named Angus one of “America’s most promising CEOs” and the company was recognized as the “Best Place to Work” for six years running under his leadership.Jonathan Ehrlich

Jonathan specializes in investing in early-stage companies. Other investments include Virtual Kitchen co, Apply Board, Flexport, Front, EquipmentShare, and TrueBill. He is also a founding partner at Roar Ventures.Ashu Garg

Ashu works with startups across the enterprise stack. He is particularly excited about how machine learning and deep learning are reinventing existing software categories and creating new consumer experiences. And he has invested in AI-enabled business applications (such as marketing technology and HR technology), data platforms, data center infrastructure, security & privacy, as well as online video. Ashu is an early investor in one decacorn (Databricks) and six unicorns (Cohesity, Eightfold, Amperity, Turing, Anyscale, and Alation) … so far. He serves on the boards of Anvilogic, Arize, Coefficient, Cohesity, Conviva, Eightfold, Fortanix, Ikigai Labs, Levo, OpsMx, Stacklet, Skyflow, and Turing. In addition, Ashu was responsible for Foundation Capital’s investments in Aggregate Knowledge (acquired by Neustar), Custora (acquired by Amperity), FreeWheel (acquired by Comcast), TubeMogul (acquired by Adobe), and Tubi.tv (acquired by Fox).Rodolfo Gonzalez

Rodolfo is fascinated by financial disintermediation, peer-to-peer funding, and bringing transparency and simplicity to the consumer experience. As a kid, he wanted to be a professional soccer player or movie actor; but he grew into an adult with a passion for promoting economic growth and inclusion through innovation in financial services. When Rodolfo was 17, he co-founded his first startup, Mexplosion, to host the Mexican qualifiers for the World Cyber Games e-gaming competition in 2001. His second and more recent entrepreneurial venture was a crowdfunding platform for social enterprises called YouVest.Charles Moldow

Charles’ primary focus is on identifying technology trends and new user experiences that will change the financial services landscape. His thesis investing has him focused on fintech, insurtech, and proptech opportunities with a crypto overlay to everything he evaluates. Charles’ public portfolio includes early-stage investments that have led to notable IPOs with DOMA (IPO 2021), Rover (IPO 2021), LendingClub (IPO 2014), OnDeck (IPO 2014) and Everyday Health (2014). Notable trade sales include One Finance (Walmart JV), Finxera (PE), CoverWallet (AON), Refresh (LinkedIn), Powerset (MSFT), Xoopit (Yahoo!), CloudOn (Dropbox), Zoomer (Grubhub), Adwhirl (Google).

Zach Noorani

Zach joined Foundation in 2014. He’s interested in all things fintech, more specifically helping drive fundamental product innovation in financial services markets across the globe.Steve Vassallo

Steve invests at the intersection of design, technology, and business: at the sweet spot where a product meets a real user need, is built atop a unique insight or technological breakthrough, and has the potential to be a massive business. He is drawn to founders with two predilections: First, having spent the initial five years of his career designing products at IDEO, Steve gravitates towards product-first founders, who understand how to build technology that delights and improves the lives of its users. Second, he is drawn to founders who want to solve consequential problems. Steve is excited by entrepreneurs who are trying to use technology as a lever to better the world and create something of deep and lasting impact. Steve invests across all of Foundation Capital’s practice areas and he co-leads the firm’s crypto practice.dave barrett

Dave is a partner in our Boston office and focuses on investments in healthcare and technology. He also serves as a managing partner of Polaris Funds VI – IX. Dave joined Polaris in 2000 after his first career as an operating executive and entrepreneur. He currently represents Polaris on the boards of Cohere Health, Egnyte, NDVR, Notarize, OM1, SimonData, Sonrai Security, TauSight, and also works with Armorblox, Akili, Allstacks, Lob, PathAI, and Quartet Health.Marissa Bertorelli

Marissa joined Polaris in 2019 and is a principal in the firm’s San Francisco office and is primarily focused on healthcare investments. She currently serves on the Board of Directors of Amplifire and Blue Rabbit, and as a Board Observer to Auron Therapeutics, Cohere Health, BeMe Health and Livara, and has also served on the board of Foresight Mental Health.Alexandra Cantley

Alexandra joined Polaris in 2019 and serves as a partner in the New York office. She is primarily focused on early-stage biotech and healthcare investments. She currently serves on the Board of Directors of Auron Therapeutics, BeMeHealth, Podimetrics, SunBird Bio, and TRex Bio, and as a Board Observer to Engine Bio.Brian Chee

Brian is a managing partner in the San Francisco office and focuses on investments in healthcare companies. He joined Polaris as an associate in Boston, shortly after the firm was founded in 1996. Brian works with several Polaris portfolio companies including Ajax Health, August Bioservices, Neumora Therapeutics, Nomad Health, and Quartet Health, and serves as chair of Lola Development and US HealthVest.Sabrina Chiasson McLaughry